There is a range of of unquoted Business Relief products (BR – formerly Business Property Relief or BPR) that market themselves as low risk. I have noted elsewhere that managers created most of these in the last few years. Consequently, as yet, very few have been tested through a full business cycle.

As Warren Buffet famously said, its only when the tide goes out that you see who hasn’t got any trunks on. Clearly the tide is going out now and we may find out some truths!

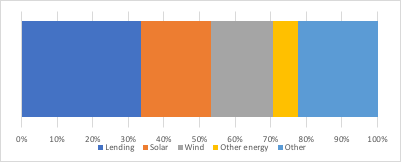

Sector exposure

This is a chart that I produced for a conference a couple of years ago. We are currently updating it, but it gives a good sense of what exposure investors have to different trades or assets. Energy generating assets, primarily renewables, are the largest in aggregate. Lending exceeds any of the individual energy classes, though there are several different types of borrower within that. ‘Other’ includes a wide range of assets, with exposure to leasing, forestry, hotels and care homes amongst others.

Different products give investors very different exposure to each strategy. There is also much variation in how different managers run each trade. For example, gearing levels vary widely. Nevertheless, by looking at the strategies we can get an idea of where concerns may arise.

The debate about what the true risk levels are has been stimulated by the issues that the industry has experienced in the last few years. Although Oxford Capital kept information under wraps, their product closed over a year ago due to issues with anaerobic digestion and reserve power. Credit quality has been an issue to some extent for at least three other providers. Each has made provisions well ahead of what would be expected for low-risk lending in a benign credit environment.

I have recently consulted with a few managers, most of which are performing as we expected. However, I wonder about the couple who haven’t replied yet!

Energy assets

While there are some operational differences between the different energy assets, the commonalities are much stronger. In particular, the revenue structures are essentially the same. The exact split between revenues from electricity sales and government subsidies varies from project to project. Managers are usually fairly open about their experience. Each is subject to different factors.

Market electricity prices

Prices in the open market are, to a large extent, a function of supply and demand. With a large number of people working from home, the pattern of use has changed substantially. Although there is increased domestic use, commercial consumption has dropped substantially. The net result is overall demand is lower, with one report suggesting a 13% decrease. UK prices have fallen accordingly – current wholesale prices are a third below where they were a couple of months ago.

It is not clear yet how much effect that will have on BR companies. A quick return to more normal activity should bring a recovery in electricity prices. At current levels, short-term revenues are likely to fall short of assumptions. However, long-term projections will likely show less dramatic moves unless the hiatus lasts an extended period. Octopus, in their recent update, noted that long-term forecasts had been reduced, but these changes don’t appear to be anywhere near the order of magnitude of short term changes.

The degree to which this affects different managers will also depend on the Power Purchase Agreements (PPA) that are in place. A fixed price PPA will mitigate the effect, though few of these are fixed for long-terms. They may reduce short term effects though. PPAs at market prices will have no mitigating effect.

A random factor may be the current oil/gas price. This has plummeted due to excess supply and weak demand. If this excess takes time to work out, then generators burning fossil fuels may get a cost advantage. Any hedging could mitigate this though, so it is hard to be sure what effect, if any, we will see from this.

Subsidy payments

For many companies, subsidy payments provide the majority of the revenue. They are index-linked, increasing each year in line with the Retail Price Index. Most, but not all, managers assume 2.5% p.a. in their valuations. This is actually a little conservative relative to the Bank of England target.

The likelihood is that, in the near future, RPI growth will fall short of that. We have already seen it start to fall since the lockdown took effect. Given the economic weakness, this seems likely to continue for some time. However, this will have a small effect on revenues for most BR companies for a year or two as it reduces expected revenue growth. It is unlikely to change long-term assumptions.

Operational risks

As it happens, wind had a good first quarter, with generation above expectations. Solar was not exceptional, but may be catching up a bit now.

Both solar and wind assets can run reliably with only occasional manual interventions for maintenance. Social distancing measures will have little impact. Farms are operating pretty much as normal, and supplies for anaerobic digestion plants should be continuing as planned. Biomass could be more vulnerable, but this is a very small part of the sector.

Reserve power has had plenty of issues over the last couple of years. With more stable demand, there seems likely to be less need for them during the crisis. However, their finances have historically depended more on payments for availability. The questions around those remain unaffected by the current situation.

Asset valuations

The only update so far has come from Octopus. The 2.5% fall in the Fern share price was attributed to long term forecast movements only. Both energy prices and inflation assumptions feed into asset valuations, but movements in discount rates may have a bigger effect. The challenge is to know what those would be.

We can see that risk free rates have fallen, while credit spreads have jumped. Like equity markets, spreads have seen some recovery but nowhere near earlier levels yet. We can’t look at transaction data because there simply hasn’t been anything meaningful since the crisis hit. This may be true for a while: these deals take time to do and I suspect only forced sellers will rush one through just now.

However, by looking at the quoted energy funds we can get a sense of what is going on. Like most assets, they sold off heavily in March but have partially recovered since then. Currently they are ca. 10%-15% below the prices they were trading at 2-3 months ago. The read across to BR is not clear as that these funds have consistently traded at a premium to NAV. We don’t know to what extent this fall is expected NAV decline or simply rating compression.

One of these, The Renewables Infrastructure Group, has given a trading update. It suggested that the effect of energy price movements would be to reduce the NAV by 5p per share. The last declared NAV was 115p as of 31 December 2019. It said nothing about discount rates. While its international profile may not exactly match the BR sector perfectly, it does give a reasonable indication of where it currently stands.

Energy summary

While the environment is far from positive, it doesn’t look terrible for energy assets. Near-term earnings may be weak, though, for some, recent generation strength may offset that. The valuation impacts, so far, are negative but look limited.

Lending

Lending is the most common trade in the BR sector – almost two-thirds of products have exposure. By far, the majority of this is property lending, with exposure to developments, both residential and commercial, bridging loans and energy companies. Other lending includes media and various forms of SME finance.

The vast majority of lending is secured, so the considerations for investors are:

- will borrowers default?

- if there is a default, will the security cover the loan?

Investors should be cognisant of the effects of diversification. A well diversified loan book will have more loans. While this increases the likelihood that a company will have exposure to bad debts, it limits the effect of any one loan. Broadly, I believe too much of the sector is inadequately diversified. For investors sake, they should hope I am wrong.

As discussed above, energy assets (often described as infrastructure by lenders) should be operating as normal. There seems little additional likelihood of default in the current environment.

Development lending and bridging loans

The situation for other property lending is less clear, but it is too early to know for sure. Risks for developers are principally not being able to finish projects or being unable to sell the finished property for the expected price. Either of these could lead to a default.

While most sites still appear to be working, some have had to stop due to social distancing requirements. We have also heard that some sites have been unable to obtain supplies. The longer the lockdown goes on, the more likely that is to be an issue, though we have also heard of efforts to unblock that.

If the manager has been underwriting well, then the developers should be able to withstand a shutdown of a few months. They can furlough staff and residual costs, other than funding, should be limited. However, lenders may have to extend loans, and concessions on other terms may be required.

It looks likely that, unless pre-sold, revenues from sales will be lower than expected a couple of months ago. The weakness in other asset classes strongly suggest property prices will be lower. The property market has pretty much ground to a halt, so we can’t be sure by how much. Surveyors estimate falls of 5%-10%, but at the moment that can’t be more than educated guesswork.

It seems likely, again, that price declines will depend on how long we are in lockdown. An extended period could see substantial falls. In 2009 we saw an average fall of 20% over 16 months. Most BR products have loan-to-value ratios that are conservative in normal conditions, with averages mostly in the 50% to 70% range.

However, averages can disguise much variation. It is the highest LTV loans that are most at risk and some are within the range of historic declines. But exposure varies widely between managers, with some consciously avoiding hot-spots that may be vulnerable to larger falls. The picture is far from clear. If a problem materialises, I believe it is most likely to come from this area. However, it will take a significant further decline to create issues for the whole sector, although a lender or two may have issues without that.

Other lending

Media lending has been a low risk area for investors to date. I haven’t managed to speak to any of the media lenders, so haven’t had a chance to probe my concerns. Filming has largely stopped. The nature of the industry is that it can restart fairly easily when allowed, which should be positive for lenders.

However, there is a danger of key talent not being available. An actor booked for another project in the summer may no longer be available, which could prolong delays. It is not clear to me how big a risk this really is, but it can’t be ignored.

Most security is contingent on completion. Usually that is more a matter of when rather than if, but there may now be doubt for some projects.

It is difficult to generalise about SME finance. Partially this is due to its variety, but also that lenders have varying buffers and reserving policies. Security also varies widely. However, it is clear that most of the SME sector is finding it tough. Again, the length of lockdown matters greatly. If it is short, then the effects may be restricted to reduced 2020 returns. A longer hiatus may cause more defaults and also affect the value of security, with a greater effect.

On the plus side, we know the government is keen to support this area. While the schemes have had issues to date, this does encourage us believe that the worst case scenarios can be avoided. I have even heard of some, admittedly small, areas of financing that are doing better than usual.

Lending summary

The risks in lending could be higher than for energy assets, but that does depend on the length of the lockdown and economic downturn. A quick end may see the sector emerge largely unscathed. A longer one could be more difficult. All the lenders I have spoken to are doing their best to behave responsibly in the circumstances. We saw in the last recession how bank actions often made things worse for their borrowers e.g. this and this. It sounds like the managers are trying to avoid the same things happening.

Other trades

It is difficult to generalise for the variety of trades that are out there. A couple of brief comments:

- Forestry: trees keep growing! Seriously, demand for forestry has remained strong into April. Harvesting can continue if required, though the effect on timber prices is not yet clear.

- Leasing: the considerations have much in common with lending. A large portion of the sector’s assets effectively have government backing, though some do not. Residual values could be adversely affected, but it is not yet clear if they will be.

Final comment

It is always important for investors to remember that low risk does not mean no risk. We are still in the trough of uncertainty and, right now, it is difficult to be sure about anything. However, it looks like returns in 2020 could be well below targets.

BR investors usually care more about their capital than returns. If circumstances stay as they are, then most investors will see limited capital impact. However, there may be exceptions for any managers whose underwriting has not been as robust as they thought, or are inadequately diversified and unlucky. But, if the tide goes out further then there may be a greater impact.

My best guess is that, to date, most of the sector has delivered on its promise. It isn’t over yet though and we will watch how things develop with interest.

4 May: updated following further information from providers.

Pingback: The 3 best books on Inheritance Tax|Find the right IHT help - BM Research